Eion bets big on olivine, partners with agribusinesses to scale enhanced rock weathering on U.S. farmland

It is harvest time for the first carbon credits created in Eion Corp.'s first large-scale ERW project,Twinterstellar 3021.

The project reached large-scale deployment in 2023 and 2024 when the company supplied 15,000 tonnes of finely-ground olivine mineral powder to farms where it was distributed on about 3,640 hectares (9,000 acres) of pasture and corn-soybean land located in the southern U.S. state of Mississippi, including a few fields in adjacent Louisiana. This is one of the largest deployments of ERW to date in the United States.

The first carbon credits from the Twinterstellar 3021 project —(748 credits)— were issued in September 2025. The credits were issued following an independent auditor's finding of compliance with the Puro.earth Standard Edition 2022, Version 2. While the Puro.earth Registry has issued more 1 million tonnes of carbon credits overall, Eion's issuance marked the first credits generated under the registry’s ERW methodology.

Although 748 credits is a small number in the context of global carbon dioxide removal (CDR), Eion plans to create approximately 12,000 more credits from the Twinterstellar 3021 project over the coming years. One credit corresponds to one tonne of verified carbon removal. While the sale price of Eion's credits has not been publicly disclosed, Eion's CEO Anastasia Pavlovic stated in a September 2024 interview that Eion's credits were selling in the range of $300 to $400 (USD) per tonne.

Eion performs most functions along the ERW supply chain. Upstream activities include securing project financing, enrolling farmers, procuring and analyzing olivine to determine application rates, and coordinating delivery to farms. Downstream activities include measuring weathering rates and CO2 removal, and submitting verification data to the Puro.earth Registry, which in turn provides the data to an independent auditor.

For the Twinterstellar 3021 project, Eion's weathering measurements were reviewed by a certified independent auditor, 350Solutions, who verified compliance with the Puro.earth ERW Standard. Puro.earth subsequently issued the 748 carbon credits as CO2 Removal Certificates (CORCs). Eion then delivered the CORCs to buyers who used them to offset their emissions and retire them in the Puro.earth Registry.

Revenue from carbon credit sales supports Eion's operations. Farmers benefit from olivine’s natural buffering effect in acidic soils, which offers a lower-cost alternative to traditional Agricultural lime. In regions where agricultural lime is expensive, olivine can provide savings of up to $50 per ton (U.S. short ton, 2,000 lbs). Conventional agricultural lime treatment is also a slight net positive carbon .

Beyond Twinterstellar 3021, Eion has executed agreements to remove more than 80,000 tonnes of CO2 by deploying ERW on farms in the eastern United States over the next five years (see table below).

Trans-Atlantic olivine: From mine to farm

Eion's use of olivine as an ERW feedstock contrasts with other large ERW operators (e.g., Lithos, Terradot, and Mati Carbon) who primarily use basalt rock as a feedstock. Olivine is composed of mainly magnesium silicate (Mg2SiO4), which reacts with carbonic acid to form dissolved magnesium (Mg2+), bicarbonate (HCO3-), and silica (SiO2). Basalt, by contrast, is a mixture of olivine and other silicate minerals, including feldspar and pyroxene.

The appeal of using nearly pure olivine in ERW is that it dissolves more quickly than basalt. Faster dissolution means faster carbon capture and hence faster generation of carbon credits.

A potential drawback of olivine is that it contains trace metals such as nickel and chromium, which — if present in sufficient quantities — could adversely impact vegetation or groundwater. Basalt presents similar concerns. Eion addresses these risks through extensive soil sampling and geochemical analysis, comparing results against U.S. Environmental Protection Agency risk exposure models to confirm that metal concentrations remain within safe limits.

Olivine is typically sourced from olivine-rich rocks such as peridotite and dunite, which form deep within the Earth’s mantle and are brought to the surface over geological time through tectonic processes. Basalt, by contrast, originates from relatively shallow magma chambers and erupts onto the surface during volcanic activity.

Eion sourced olivine for its first carbon credit issuance under the Twinterstellar 3021 project from the Twin Sisters Olivine mine in the western U.S. state of Washington. However, most of the project's olivine was supplied by Sibelco, a much larger olivine producer, located in Åheim, Norway — more than 8,000 km away by ocean. Sibelco's Åheim mine is the largest olivine mine in the world, supplying approximately 80% of the global demand, with production capacity of about 4,500 tonnes per day.

Crushed olivine is primarily used in the steel industry (e.g., furnace linings, molds, and slag conditioning) due to its resistance to high temperatures. Sibelco also invested in Eion's Series A funding round in 2022.

After fine crushing at the mine in Norway, olivine was carried by ship across the Atlantic Ocean to the Port of New Orleans, then delivered by truck to individual farms.

Capturing CO2 on the farm and storing it in the ocean

Eion provides olivine powder to farmers under the trade name CarbonLockTM, pricing it below traditional agricultural lime on a one-to-one substitution basis. The company covers the cost of olivine procurement, delivery, soil sampling, and analytical testing. Farmers or Eion-contracted applicators spread the olivine using standard lime-broadcast equipment, requiring no changes to planting schedules or crop rotations.

The olivine acts as a mild liming agent, buffering soil pH while supplying magnesium and other nutrients.

The process of capturing and storing CO2 in Eion's projects is similar to that of other ERW projects, whether the soil amendment is basalt or olivine. Simplisticly speaking, as olivine chemically breaks down (weathers) in soil it forms bicarbonate (HCO3-), which contains the 'C' from CO2 in rainwater that infiltrated the soil.

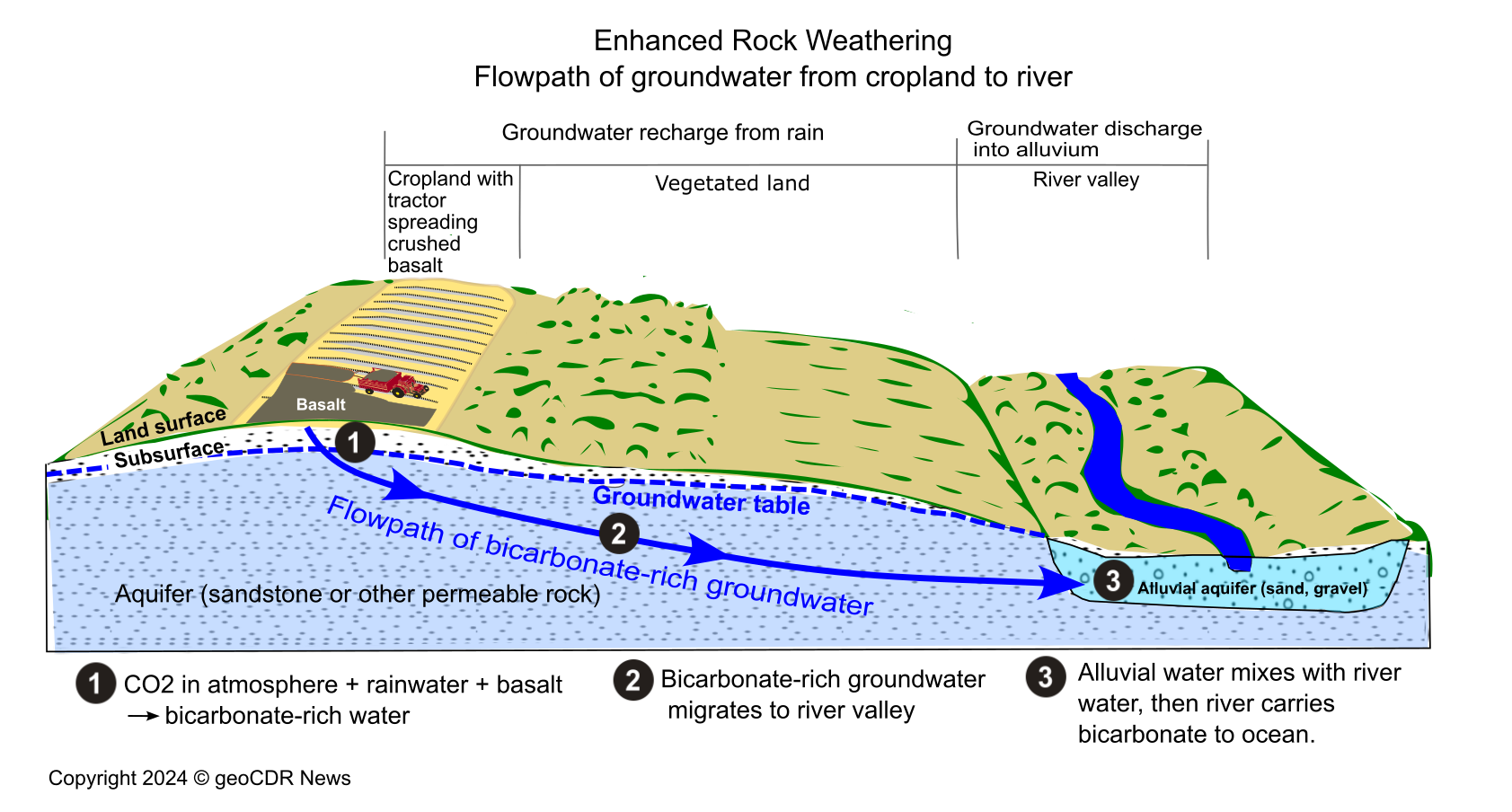

Bicarbonate is stable for more than 1,000 years as it is transported via groundwater and surface water from soils to rivers and ultimately to permanent storage in the ocean (see diagram of below).

Eion recommends applying 2 tonnes of olivine per acre (5 tonnes per hectare). CO2 uptake occurs over one to four years, with the company estimating each tonne of olivine captures nearly of CO2.

A central component of Eion's ERW projects is its measurment, reporting, and verfication (MRV) framework. The relies on soil and water sampling to track semi-mobile tracers (e.g., nickel) in the topsoil and the depletion magnesium and other ions. These data are used to quantify the amount of alkalinity (bicarbonate) generated and transported through the soil as a result of olivine weathering. Eion collected soil samples on a 1-hectare (2.5-acre) grid, supplemented by stream sampling and geochemical modeling to establish a high-confidence MRV framework aimed at boosting scientific credibility of Eion's carbon credits.

Eion also submitted a confidential, site-specific life-cycle assessment (LCA) to Puro.earth, which was reviewed by the independent auditor. The LCA accounts for emissions associated with mining, processing, transportation, and spreading. Hydroelectric power supplies most operations at Sibelco’s Åheim mine, contributing to the overall carbon-negative profile of olivine sourced from Norway.

New funding and agribusiness partners

Eion was founded in 2020 in Princeton, New Jersey (USA) by two Phd scientists, Adam Wolf and Elliot Chang. (Chang has since joined Lithos Carbon.) Early research included greenhouse studies on ERW application rates at Rutgers University and soil-column experiments at the University of California, Berkeley.

The following table summarizes Eion's funding chronology. In 2021, Eion successfully applied to Stripe Climate for a grant and for a pre-purchase of carbon credits to be delivered later. Stripe Climate is the carbon removal purchasing arm of Stripe, an online payment and invoicing company. Stripe provided a $250,000 grant for developing , , and research, and it $250,000 of carbon credits, thus enabling Eion to firm up its business concept.

Since 2021, Eion has received three multi-million dollar capital infusions in the form of carbon credit pre-purchase agreements and equity investments. Some of the equity investors are also part of Eion's supply chain, including the olivine supplier in Norway, Sibelco, and Growmark, an agricultural cooperative serving about 400,000 farm customers across North America.

Eion executed its biggest carbon credit pre-purchase agreement to-date in early 2025, a $33 million (USD), multi-year carbon removal offtake agreement with Frontier Climate. Frontier is a coalition led by Stripe, Alphabet, Shopify, and Meta. The deal commits Eion to capture 78,707 tons of CO2 between 2027 and 2030.

In early 2025, Eion announced its largest carbon credit pre-purchase to date: a $33 million, multi-year offtake agreement with Frontier Climate, a buyer coalition led by Stripe, Alphabet, Shopify, and Meta. Under the agreement, Eion committed to removing 78,707 tonnes of CO2 between 2027 and 2030.

Also in early 2025, Eion announced a carbon agreement with Perdue AgriBusiness (a subsidiary of Perdue Foods), under which Perdue-managed farms in the Mid-Atlantic region of the U.S. will apply Eion’s olivine, removing approximately 3,500 tons of CO2. The deal may represent the first large-scale use of ERW for agricultural insetting.

| Buyer / Partner / Investor | Year (link) | CO2 Volume (tonnes) | Deal / Round Value (USD) | Type | Notes |

|---|---|---|---|---|---|

| Frontier Climate buyers | 2025 | 78,707 | $33,000,000 | Pre-purchase | Delivery 2027–2030, ERW in southern and midwest U.S. |

| Perdue AgriBusiness | 2025 | ~ 3,500 | Not disclosed | Pre-purchase | ERW on Perdue's Mid-Atlantic region grain farms; first-of-its-kind insetting model. |

| Microsoft | 2024 | 8,000 | Not disclosed | Pre-purchase | Delivery in 5 years from ERW on Mid-Atlantic region U.S. farmland |

| Series A extension (investors: Growmark, AgFunder, Ridgeline, et al.) | 2024 | N/A | $3,000,000 | Equity | Funding to accelerate commercialization. Partnering with Growmark gives access to more U.S. farms. |

| Stripe Climate | 2023 | Not disclosed | $1,000,000 | Pre-purchase | Renewal of 2021 agreement, followed early delivery of 50 tons. |

| Series A (investors: AgFunder, Ridgeline, Sibelco, et al.) | 2022 | N/A | $12,000,000+ | Equity | Funding to scale CarbonLockTM olivine production and distribution |

| Stripe Climate | 2021 | 500 | $250,000 | Pre-purchase | One of Eion's first carbon credit sales. |

| Stripe Climate | 2021 | N/A | $250,000 | Grant | Develop MRV, LCA, research. |

Eion is also a founding member of the Enhanced Weathering Alliance, launched in 2025 to coordinate science, agriculture, policy, and markets in the responsible scaling of ERW. The coalition includes multiple ERW companies, non-governmental organizations, and agribusiness stakeholders.

Eion is targeting 10 million tons of annual CO2 removal by 2030. With corporate buyers demanding more permanent forms of carbon removal and policymakers emphasizing verification and permanence, Eion’s bet on olivine positions it as a distinctive player in the growing ERW sector.